Suppose you need a loan in a hurry and you go to the bank to get an loan. However, you find out that their process is very slow and complicated, which will take a lot of time!

And then Online Loan Apps come to your mind, who claims to provide you loans instantly. One of those top loan apps is the PaySense Loan App; it has more than 10 Million+ downloads on the Play Store.

So today, I am going to review the PaySense Loan App and tell you if it is trusted or not. Will they scam us? What’s their interest rate, loan amounts, Required documents to get a loan, eligibility, and much more.

I will share reviews and experiences of users who have got loans from PaySense and answer your every question. And Finally, I will help you decide whether you should take a loan from them or not, so without delay, let’s start.

Types of Loans available through PaySense

Let’s first know how many types of loans you can take from PaySense:

- Personal Loan: Whether you need money for your dream wedding or for any other personal reason, you can take it from PaySense.

- Vehicle Loans: If you need a new or old 2 wheeler/4 wheeler vehicle, you can take a loan for that too.

- Student & Education Loans: If you need money for education, such as school/college fees, books or tuition expenses.

- Consumer Durable Loans: To buy any expensive essential item for the home.

- Medical Emergency Instant Loans: For medical emergencies and medicine expenses.

- Instant Cash Loans: Whenever you need cash instantly for any personal issue.

- Travel Loans: If you need money to travel somewhere or to go to another country.

So PaySense can provide you instant loan for almost every reason.

Loan Amount, Interest Rates & Tenure of PaySense Loan

You can take a loan from PaySense from a minimum of ₹5,000 to a maximum of ₹5,00,000.

Talking about interest rate, PaySense’s Annual Percentage Rate (APR) on personal loans can range from 16% to 36% on.

You get a flexible tenure to pay the PaySense loan, which ranges from a minimum of 3 months to a maximum of 5 years.

PaySense Personal Loan Representative Example

Let me explain you with the help of an example that if you take a loan from PaySense, then how much can be its Interest, EMI and repayment amount:

Suppose you need a loan of ₹1 lakh, you can take it for a tenure of 24 months with an APR of 27.81%. That means you’ll pay an equivalent monthly interest rate of around 2%.

There’s a one-time processing fee of ₹3,000 to get the loan started. So you’ll have to pay ₹5,287 monthly for 24 months to repay the loan. In total, you’ll pay back ₹1,26,888, which includes the principal amount and the interest.

Pre-Payment & Late Payment Charges

Pre Payment Charges:

If you want to pay off the loan taken from PaySense before the end date, you will have to pay a foreclosure fee, which will be 4% of the remaining principal amount.

And 18% GST will also be charged on that 4%, which you will have to pay.

Late Payment Charges:

If you are unable to pay the EMI by the due date, then you will have to pay ₹500 late payment fee; 18% GST will also be charged on this, so you will have to pay a total of ₹590 late payment charges.

Eligibility Criteria

You will be able to take loan from PaySense only if you meet this eligibility criteria:

- You must be a resident of India.

- Your age should be between 21 to 60 years.

- Must be resident of city where PaySense have its service available, Check if PaySense available in your city from this this link.

- Your monthly income must be ₹12,000 (if you are Salaried person)

- Your monthly income must be ₹15,000 (if you are Self-Employed)

- Have an active Net-Banking account.

Documents Required to get loan from PaySense

To get a loan from PaySense, you will need to submit these documents:

- Proof of Identity: Submit your PAN Card or Aadhaar Card.

- Proof of Address: Aadhaar Card, Rental agreement, Water or Electricity bill.

- Proof of Income: Net-Banking or last 3 months bank e-statements showing your income.

- Photo: A clear selfie so that your identity can be verified.

Step-by-Step Loan Application Process

Step 1 – Download PaySense

First of all, you have to download and install the PaySense app; you can find it easily on Google Play Store.

Step 2 – Open and Setup

Open the PaySense app and click on Get Started. Then, sign up using your mobile number. It will ask you for some permission, which you have to allow (it is up to you whether you want to give it permission or not).

Step 3 – Complete your Account

Fill in your First name, Last Name (As per your PAN Card), Date of Birth, gender, Employment Type, Monthly Salary, PAN Number, and Address Details, and then click on Save & Continue.

Step 4 – Terms & Conditions

Then, they will ask you to accept the Terms & Conditions. I request that you not accept them without reading and understanding them.

Step 5 – Loan Amount you can get

A screen will appear in front of you, showing how much loan you can get. Then, you can apply for the loan by selecting your EMI Plan.

Step 6 – Select Loan Amount and Tenure

Then you have to select your loan amount along with the tenure to ensure how much time you will need to pay the loan. After that you have to mention why you need this loan!

Step 7 – Complete the process

Then, fill in your KYC details with the documents mentioned above in this article and Repayment Details. Your loan application will be submitted, and you will get the loan shortly.

WARNING: Don’t get the loan without reading the reviews below!

PaySense Loan App Review – Should you take or not?

So let’s know now whether you should take a loan from PaySense or not; I will share the reviews and experiences of those people who have already taken a loan from PaySense:

Negative Reviews – Cons

Threat Calls: Many users are saying that they are getting threat calls and messages from PaySense Recovery team and they use bad and abusive words.

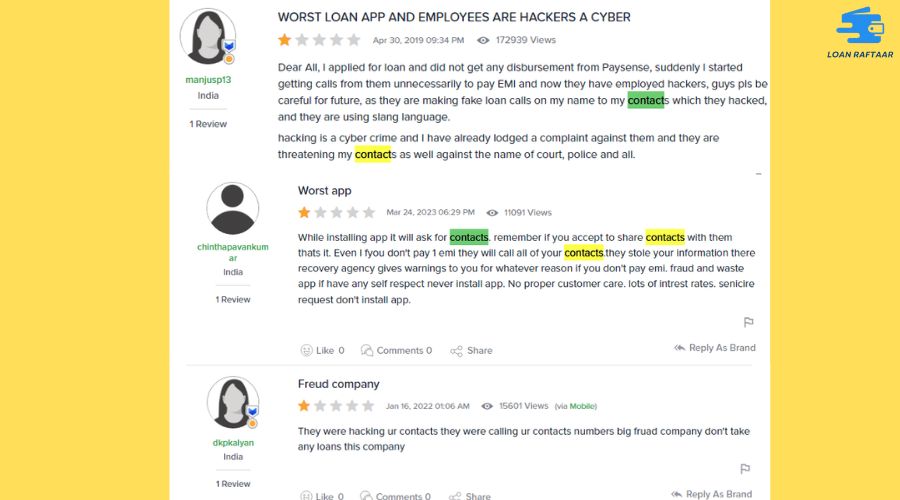

Threats to your relatives: Many people are also saying that PaySense had taken contact permission in the beginning, and due to not being able to pay EMI on time, their agents are threatening our contacts. I have attached screenshot:

No Customer Support: Some people are saying that PaySense’s customer support does not work at all. They tried to talk to the agent about some corrections and loan foreclosure, but customer support didn’t respond to them.

Not processing loan: Some people say they applied for a small loan amount and submitted all the documents. After that, they got a confirmation call, and later, their application was rejected.

After that, they do not pick up my calls or replying to my messages. They gathered my personal information and rejected my application.

PaySense got a 1-star rating from people on MouthShut. You can also buy PaySense You can read reviews about it on MouthShut:

Positive Reviews – Pros

Fast Loan Approval: Only a few people are saying that PaySense approves loan quickly. A guy named shiku9686 told that his loan was approved in 2 days and the amount was credited in just 2 hours.

PaySense has only a few 5-star reviews, and this is the only positive review I found.

Now, you should decide whether to take a loan from PaySense or not. If you are still confused, you can make your decision by reading more reviews available on MoutShut. I’ve provided the reviews link above.

Frequently Asked Questions (FAQs)

Will PaySense Instant Personal Loan affect my credit score?

Yes, PaySense works just like other personal loan providers, and it also affects your credit score. If you pay your EMIs on time, your Credit Score will increase. But if you don’t pay your EMIs on time and pay late, your Credit Score will decrease.

Can I Get loan from PaySense with zero Credit Score?

Most banks and NBFCs require a higher credit score to give a loan. But what if you have never taken a loan before and your credit score is 0, Will PaySense give you a loan?

The answer is yes! PaySense will give you a loan even if you have a 0 credit score, because they understand that everybody begins somewhere.

Can I foreclose my PaySense loan?

Yes, you can pay your remaining PaySense loan amount even before the agreed-upon repayment term. But you will have to pay foreclosure fee which will be 4% of the remaining amount and 18% GST on top of that 4%.

How to contact PaySense Customer Care?

You can contact PaySense by email, here is their email address: support@gopaysense.com. They do not have any customer care number.

Conclusion

So in this article I have given you A to Z information about PaySense like: Eligibility, Required Documents, Loan Amount you can get, Interest Rates, Tenure, Pre-Payment & Late Payment Charges and much more!

And after that I have also shared the reviews/experiences of people who have taken loan from PaySense, so that you can decide whether you should take loan from PaySense or not.

After seeing so many bad reviews, you should not take a loan from them, but maybe if you pay the EMI on time, you will not have to face these problems.

And if you have made up your mind to take loan from PaySense then you can apply for loan by following the Step by Step Loan Apply Process mentioned above.

![FiniKash Loan App Review: Scam or Legit? [Honest Opinion]](https://loanraftaar.com/wp-content/uploads/2024/10/FiniKash-Loan-App-Review.jpg)