Are you looking for an app that provides instant loans? Guess what? I recently tried the Money View loan app a few weeks ago as I was in need of some financial help.

But what exactly is the Money View loan app? Money View is an instant loan app that provides instant loans up to 10 lakhs depending on your credit score and limit.

If you do not know about the Money View loan app, here I’m sharing all the info like how you can apply, eligibility, documents, what it is even worth, and my experience, which was actually bad.

What is the Money View App?

The Money View app is an instant loan application that offers instant loans from ₹5,000 and up to 10 lakhs in 10 minutes. The loan amount depends on your credit score.

It’s an RBI-approved and ISO 27001:2022-certified loan app. It is an app that is available to download for Android and iOS users.

Hope this is clear to you. Now if you want to apply for an instant loan in Money View, in case you are in need, let me explain how you can, and then I’ll share my real experience of using this app.

MoneyView Interest Rate with example and late charges

| Fees and Charges | Amount Chargeable |

|---|---|

| Interest Rate | Starting from 10% per annum |

| Loan Processing Charges | Starts at 2% of the approved loan amount |

| Penal Charges on Overdue EMI | 24% per annum + applicable taxes, if any |

| NACH Bounce | Rs. 500 each time |

| Loan Cancellation | Can be done within 3 days; principal and other charges must be paid |

| Foreclosure Charges | Nil, but foreclosure allowed after a certain number of EMI payments |

| Part-Prepayment Charges | Not allowed |

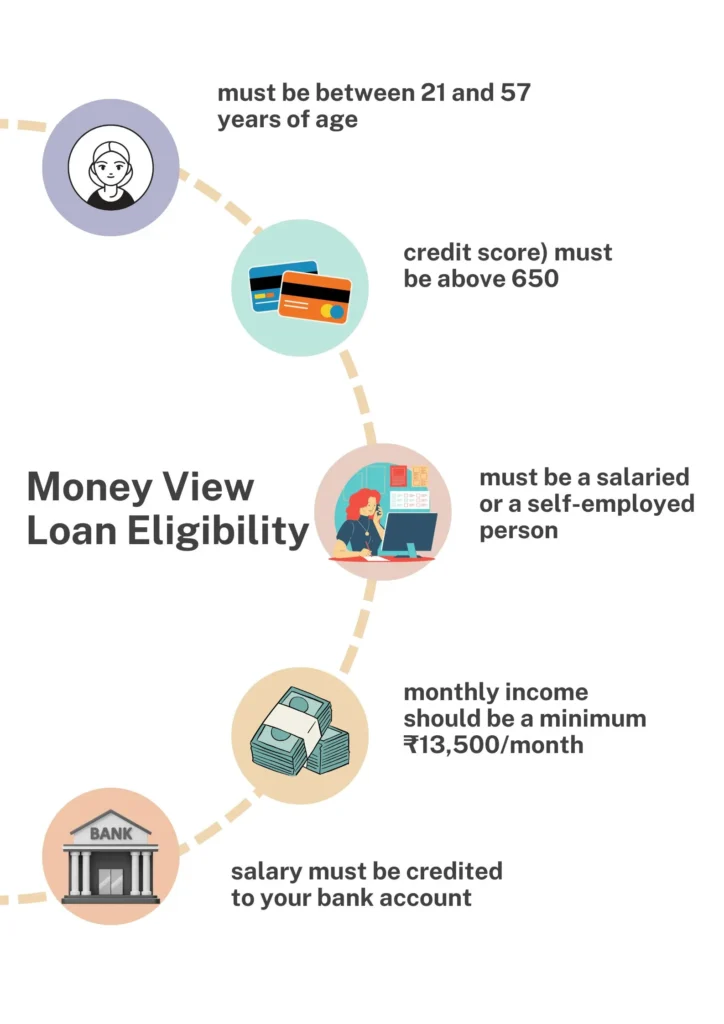

Money View Loan Eligibility

There are a few basic eligibility criteria that must be fulfilled if you want to avail of the instant loan from the Money View app. The eligibility criteria says:

- you must be between 21 and 57 years of age

- your CIBIL score (credit score) must be above 650

- you must be a salaried or a self-employed person

- your monthly income should be a minimum ₹13,500/month

- if you are a salaried person your salary must be credited to your bank account

How to Apply for a Money View Loan (Step-by-Step Guide)

The only good thing I liked about the Money View app is the easy and paperless application process. It’s really very easy to apply for an instant loan in the app.

Here is how you can apply:

- visit the official site of Money View or download the Money View app from the Play Store or App Store

- from the menu, click on the ‘Personal Loan‘ option, and a new window will open

- now enter your phone number, and click on ‘Apply Now‘, an OTP will be sent to your number for verification

- an application form will open, fill the form with all your correct details including name, DOB, gender, age, location, PAN number, etc

- it will calculate the loan amount that you can avail of depending on your CIBIL score

- now you can select the loan amount available for you and the tenure

- proceed and complete the KYC and upload the necessary documents for income verification

- once the verification is completed, your loan amount will be sanctioned

- now just enable the EMI-auto debit or NACH mandate

- accept the Money View loan agreement and avail of your loan amount

The whole process won’t take much time. They claim it will take somewhat around 10 minutes only to get the loan amount

Money View Document Requirements

Before applying for the loan, it’s good to know the documents that you’ll be required for the KYC and income verification.

Here is the complete document list:

- PAN Card

- Aadhaar Card

- Valid Indian Passport

- Valid Voter ID

- Valid Driver’s License

- Utility Bills (Electricity, Water, Gas)

- The last 3 months’ bank statements

Money View Loan Real or Fake (My Experience)

Let me now tell you my real experience with the Money View app and whether it is real or fake. I applied for an instant loan a few weeks ago as I was in need of some money.

The application process was pretty simple and easy and I instantly got a loan amount of ₹45,000. The very first thing that I didn’t like was they circulated my number to different loan apps.

I started receiving many spam calls and WhatsApp messages to take loans from different apps. I mean why? without my consent?

Okay leave this, let’s move forward to the bigger issues I faced. They do not disclose a lot of terms and conditions which are really very important.

They have the worst customer support I ever experienced in my life. But why do you need customer support?

Well well well, I bet you will definitely need customer support as you’ll encounter a lot of hidden charges and rates, which you don’t want to pay.

And Yes, they won’t pick up your call for support but they’ll definitely call you to pay the EMI before the due date and they’ll literally harass you.

I didn’t even receive my sanctioned amount and have to pay a lot of interest. There are a lot of things I can say but let me now summarize my worst experience with the Money View app:

- worst customer support

- receiving a lot of spam calls and messages

- didn’t get my sanctioned amount

- a lot of hidden terms and conditions

- a lot of hidden charges

- they’ll call with different numbers just to harass you

Money View Loan Customer Complaint

You may not believe my experience or I may be an exception and bla bla bla, but there are a lot of customers of the Money View app that have similar complaints about it.

A few of my knowns also used this app, and they faced the same issues I faced. To double-check this, I searched and contacted a few other users of this app.

Users at mouthshut.com wrote:

- “Please don’t use money view loan application they don’t give for closer and over that hidden charges is double of your EMI“

- “Very poor service No one picks up the number I have put up for the call center. Very poor service means I have been trying for 3 days and still there is no response.“

- “Don’t install this app and don’t apply for any loan in this money view app. Bahut hi bekar services hain inki. Inse kabhi bhi koi loan na leven.“

- “The app is excellent easy to use and get money within 24 hrs. Easy application process zero paperwork.“

Although a few said the app is real and not fake, which is true, it is RBI-approved, no doubt about that, but the service and management are really poor and harassing.

In contrast to the above reviews, the Money View app got an impressive 4.8-star rating in the Google Play store with 50 million+ downloads

Isn’t it shocking that the same app got just a 2.0-star rating on mouthshut.com and a 2.1-star rating on Trustpilot.com?

How to Check Money View App Application Status

The only thing I liked about the Money View app is its application process which is quite simple and fast.

If you have already applied for the loan on Money View and are waiting for the loan approval, you can check your application status in the app itself to check your application progress.

- open the Money View app

- log in using your registered phone number

- click on your profile from the side menu

- now click on the loan application status

Here you can see if your application is under review, approved, or rejected.

How to Restore Money View App on New Phone

Is MoneyView RBI Approved

Yes, the Money View app is licensed by the Reserve Bank of India.

What is the Money View Customer Care Number?

You can reach out to the Money View customer support at 080 6939 0476.

Is the Money View App available for iOS?

No, the Money View app is not available for iOS users. The app is only available for Android users. However, anyone can access the official site of Money View and avail of all the services from the website itself.

Can I Download the Money View App for PC?

No, the Money View app is not available to be downloaded on a PC, but you can access the official website https://moneyview.in/.

How much interest is on Personal in the Money View App?

The interest rate is 1.33% per month or 15.96% per annum. Apart from the interest rate, there is a processing fee that has to be paid once.

How can I change my number on the Money View App?

You can change your mobile number by clicking on your profile in the app, and clicking on your phone number to update it. You’ll receive an OTP to verify the number.

How to Add a Wallet Account in the Money View App?

You can add your wallet account. Just open the Money View app, go to the ‘accounts‘ page, and click on the ‘Wallets‘ tab.

How to Write to Money View App Query?

You can write your query to care@moneyview.in or call their customer support at 080 6939 0476.

![FiniKash Loan App Review: Scam or Legit? [Honest Opinion]](https://loanraftaar.com/wp-content/uploads/2024/10/FiniKash-Loan-App-Review.jpg)