Suppose you ever need an instant loan due to some emergency and you rush to the bank to take a instant loan, but the process there is quite complicated and time taking.

That’s where online instant loan apps comes, which claim to give you Loans up to Lakhs instantly within a short time.

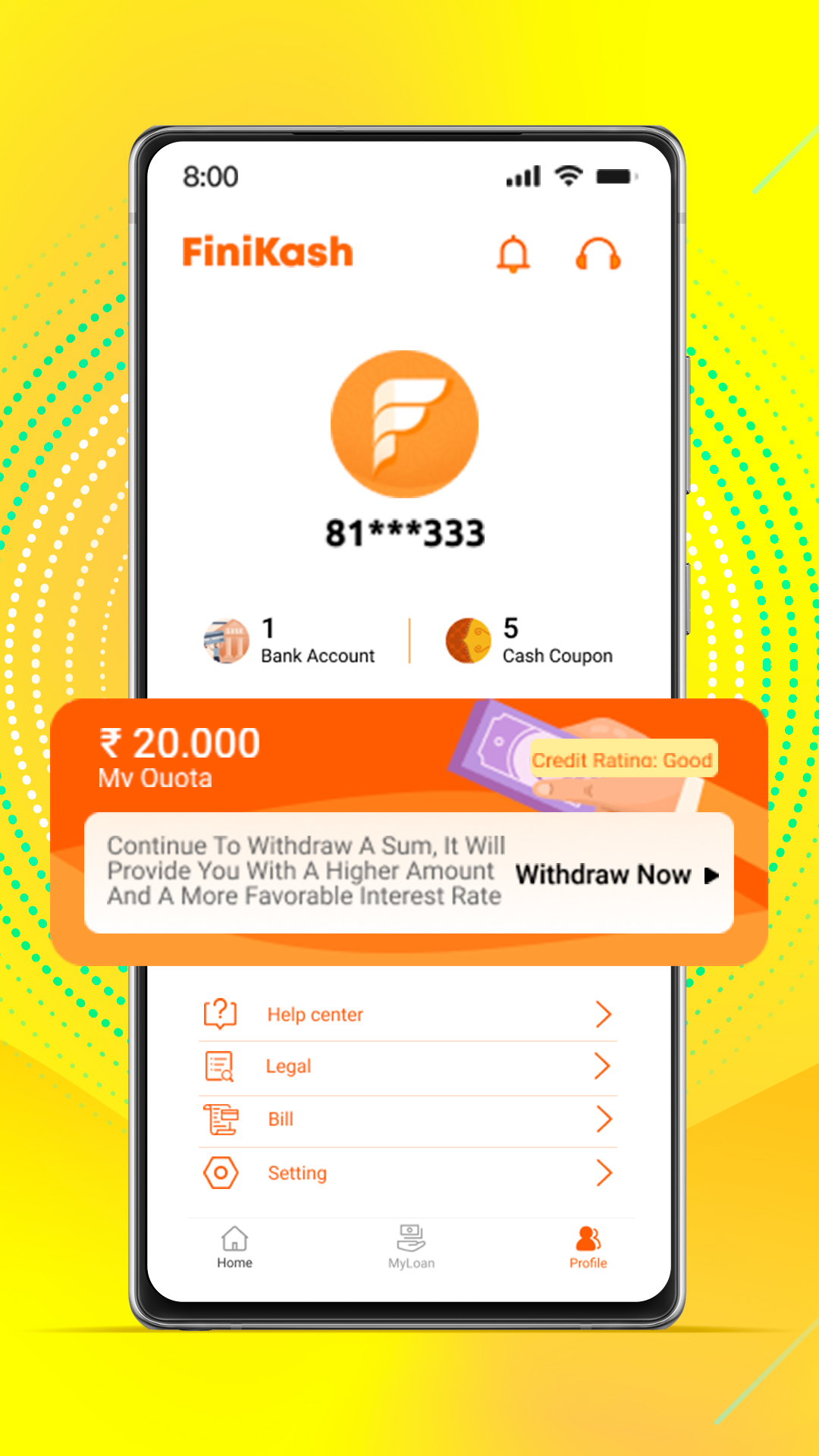

And one of those instant loan apps is Finikash, its ads keep coming on Instagram and Facebook and it’s possible you also found it from there.

But I know you must be wondering whether Finikash Loan App is safe or is it a scam company? Should you take a loan from them or not? How much interest rate do they charge? and More…

Don’t worry! Let me share my honest review of Finikash app with you to help you decide whether you should take loan from it or not!

What Is Finikash Loan App? Interest Rates, Loan Amount & Tenure

Before reviewing FiniKash, let’s know a little about it.

FiniKash is a personal loan app that claims to provide instant loans at low interest rates and with fewer documents.

FiniKash says that you can take a loan from ₹5,000 to ₹80,000 but when I downloaded this app, I found out that FiniKash gives loans from a minimum of ₹4,000 to ₹40,000.

Interest Rates: FiniKash gives loans at 18.25% Annual Interest Rate.

Loan Tenure: 92 to 180 Days

Processing Fees: 2%

Types of Loans available through Finikash

You can get a Loan from FiniKash for all these purposes:

- For Credit Card Bills: If your credit card bill is getting late and you are not able to pay it because of lack of money, you can take a loan from FiniKash. So your credit score does not get impacted negatively.

- For Travel: If you are planning to travel somewhere or you have to go somewhere in an emergency, you can also take a loan for that.

- For Shopping: If you have to buy any important item of household or anything else.

- For Medical Emergencies: If you have a medical emergency and need some money.

- For Any Personal Purpose: Whether you need money for educational expenses or for any tour, wedding, home renovation, medical expenses.

FiniKash Loan App Eligibility

There are some eligibility criteria to take a loan from FiniKash, you will be able to take a loan only if you meet the criteria, here is the criteria:

| AGE | 18 – 65 Years |

| NATIONALITY | Indian |

| CIBIL SCORE | 600+ |

| BANK | Active account in any Bank |

| INCOME | Must be Fixed Salary |

FiniKash Required Documents

You will not need many documents to get a loan from FiniKash, you just need an Aadhaar card. While applying for the loan, you will just have to upload the front and back photo of your Aadhaar card.

You may also have to enter your PAN Card number, I will tell you below how to apply for a loan from FiniKash and will also share its review with you to help you deciding if you should take a loan from them or not.

FiniKash Loan App Review: Should I take a loan from them?

First of all, let me tell you whether you should take a loan from FiniKash or not.

I will suggest that you should not take a loan from FiniKash Loan App because it is totally fraud and scam application, once you get trapped in its trap, it will be difficult to get out. But why? Let me tell you.

First of all, this app is not available on Google Play Store, but why? I have explained the reason for this in the FAQs section below. And to attract users, they have created an interface like Play Store on a spam website so that people feel that this site is trusted.

There is no SSL certificate on the official website of FiniKash, and Google itself says that this is a dangerous website which can threaten your privacy and security.

And there are many reasons for this, without wasting time on them, let’s know how they trap people.

How does FiniKash Loan App trap people?

FiniKash loan app is not available on Play Store, hence they place ads on Facebook and Instagram. Where they write something like “Get ₹10,000 loan in just 5 minutes“.

Due to which needy people download the FiniKash app and apply for the loan, and then the scam starts with you.

FiniKash loan app’s truth is that they give loan only for 1 week which you have to repay within 7 days. On which you have to pay 40% to 50% interest rate, which is huge!

Here’s an example to explain it to you better: Suppose if you take a loan of ₹12,000 then you may have to re-pay around ₹17-20k rupees.

What if I am unable to Repay FiniKash’s Loan?

A week after taking a loan from FiniKash, they start harassing you, your friends and contacts after a week.

But how will they know about my contacts? When you apply for a loan, you have to enter the mobile numbers of your 3 relatives. Then they send abusive messages and calls on those numbers, and threaten you to repay the loan.

And they also try to scare you by editing your photo in a **** way.

How to escape from FiniKash’s loan trap?

If you have taken a loan from FiniKash app and now want to get out of this trap then you will have to do this:

Do not repay the loan taken from FiniKash at all, even if you repay the full amount then they will again send some loan money in your account and will keep on harassing you for repayment.

And after that you will have to file a cyber complaint against them, you can do it by calling on 1930 number or even by going to the police station.

After that you should neither see nor reply to these messages and if they are harassing you at an extreme level then you should switch off that SIM.

How to apply for a loan at FiniKash?

Although you should not take a loan from FiniKash but I am sharing it for informational purpose:

Step 1: Select Loan Amount and Tenure

First of all you have to open the FiniKash app and in it you have to select the loan amount as per your requirement, and then tenure. And then click on Start Application.

Step 2: Enter Basic Info

Now you have to enter this information: E-Mail, Whatsapp Number, Marital Status, Education, Postal Code, Why you need this loan, State and City, Address, Employment Info, Company Name (If selected Entrepreneur), Operating period, Monthly Income and Job Field.

After that you have to proceed to the next step.

Step 3: Enter Contact Info

Now they will ask you to enter an emergency contact, an alternate contact and another contact. Please do not enter real numbers otherwise they will harass you and your relatives if you can’t repay the loan.

Step 4: Bank Info

Then they will ask for your bank details where the loan amount will be credited, like IFSC number and Bank Account Number.

Step 5: Identity Verification

Then you have to upload 2 photos of your Aadhaar Card, one front and one back and after that you will have to verify your face by Selfie Verification.

And after that your loan application will be submitted. I am reminding you again, Don’t take loan from FiniKash.

FiniKash Customer Care Number

| Customer Care | +91 8792912390 |

| help@finikash.com | |

| Location | 5th Floor, Vatika Business Centre, Outer Ring Rd, Kaverappa Layout,Kadabeesanahalli, Bengaluru, Karnataka 560103 |

| Founder Name | Unavailable |

Frequently Asked Questions (FAQs)

Is FiniKash available on the Google Play Store?

Some time ago, FiniKash was available on Google Play Store. But this app was removed from the Play Store later because it is very risky and spam application.

Is FiniKash RBI approved?

No, FiniKash loan app is not approved by RBI at all, which means that if you take a loan from here, you can be scammed.

Does FiniKash have NBFC Partner?

No, FiniKash does not have any NBC partner, and neither do we know the owner of FiniKash. Which gives us the assurance that this is a scam!

Conclusion

So FiniKash Loan app is totally a scam and you should not take loan from it because it is neither RBI approved nor does it have any NBFC partner.

I have also shared the reviews of the people who have taken loan from them in this article about the kind of harassment they are facing.

And if you have taken loan from FiniKash loan app then I have also shared with you the way to get out of their scam trap in this article.

If you want review of any loan application then tell us by commenting, we will write a detailed review on it for you.