Let’s face the elephant in the room, many people face financial strain at the end of the month.

According to a report by the Economic Times, “81% of people exhaust salary before month end“.

Banks do lend loans but they can take up to 3 weeks or more to process the loan, this is when instant loan apps like FlexSalary come into the picture.

FlexSalary loan app provides instant personal loans to anyone who is in need.

But one should always know the inside-out terms and conditions, interest, repayment structure, pros & cons, and the customer opinions and reviews of any app or scheme providing the loan.

The purpose of this article is to educate you and everyone and let you know what their customer thinks, Is the FlexSalary loan app even legit?

What is the FlexSalary Loan App?

FlexSalary is an instant loan app that provides a line of credit loan of up to 3 lakhs against your salary.

It’s an RBI-approved app and the main aim of this app is to help the salaries person get instant loans when needed against their salary.

One good thing about this app is the loan procedure. The loan application process is very easy and instant.

As per the various customer reviews, the loan credit line is approved within 24 hours and the applicant can use the amount as it gets the approval.

Now, let’s first understand the application process and interest rates of the FlexSalary app, and then we’ll discuss the customers’ reviews.

FlexSalary Loan App Eligibility

Before applying for a loan, it is good to check if you are actually eligible for the loan or not.

As it is mainly for salaried people, you must have a minimum salary of ₹15,000-₹30,000/month depending on the city you are in.

Apart from this, the minimum age should be 21 years and a maximum of 65 years.

Here is the complete eligibility criteria that must be fulfilled before applying for the FlexSalary loan app.

| Criteria | Eligibility Requirement |

|---|---|

| Age | Minimum: 21 years, Maximum: 58-65 years |

| Employment Type | Full-time employees of reputable organizations, government, or MNCs |

| Minimum Income | ₹15,000 to ₹30,000 per month (varies by location) |

| Job Stability | At least 1-2 years with the current employer |

| Credit Score | Minimum 650-700 (higher scores improve approval chances and interest rates) |

| Debt-to-Income Ratio (DTI) | Ideal ratio below 40% |

Document Required for FlexSalary Loan

Some important documents required to apply for the FlexSalary loan app are:

| Identity Proof | Aadhaar Card, PAN Card, Passport, or Voter ID |

| Address Proof | Utility bills, rental agreements, or government-issued documents |

| Income Proof | Recent salary slips, bank statements (3-6 months), or Form 16 |

| Employment Proof | Offer letter, appointment letter, or employment certificate |

FlexSalary Loan App Review: Real or Fake?

FlexSalary Loan app has 50 lakhs+ downloads on the Google Play Store with an average rating of 3.8 while it has a rating of 4.2 on the App Store.

It is an RBI-approved loan app that clarifies that the company is not conducting any scams and is not a fake company.

To avoid any debt trap. let’s see what is their customer reviews and opinions to know whether a loan from this app is worth taking.

FlexSalary Loan App Customer Reviews and Complaints

On the Google Play Store, the app has 48k+ customer reviews with an average rating of 3.8.

Out of these 48k reviews, 15k customers have given it just a 1-star rating, which is not a small number. It simply means more than 30% of the customers do not like this app.

Here is what the customers at the Google Play store wrote:

“Is this is fraud app who takes documents and shared with third party that’s what I feel because I provided the every detail and on the there are 3 steps showing 1. Verified details which is done, 2. Evaluating profile which is also done, 3. Finalising Limit there app stuck and keep loading which maybe never stop loading and nothing else in app as It’s feel fraud app sign. Kindly stay away don’t go with rating they have provided false rating maybe promotional so, keep yourself safe and stay away.”

But it’s not fair to judge any company or app on the basis of just one review platform, let’s check other public opinion forums as well.

On Trustpilot, the FlexSalary loan app has a rating of 2.4, which is a poor rating. Here is what a user wrote on Trustpilot:

“WORST APP EVER SEEN. I am paying emi on time and i have not registered ecs. but they hit ecs on from my account without my concern. They are calling 8-10 days before from due date. they called multiple time. they are calling more than 10-20 times before due date.”

On Mouthshut, the users have given just a 1-star rating for the app. The user of this app wrote:

“Please DO NOT EVER EVER opt any loan or credit from Flex Salary or Vivifi India Finance Private Limited. They charge heavy interest which goes upto 60% p.a. I have experienced that I took credit of Rs 130000 and after paying Rs. 51000 for 7 months I still have outstanding amount as Rs 138000, so BE AWARE and understand that it is TRAP. You will loose all your money taking loan and credit from this company”

We still did not want to fully believe in the online reviews and ratings, so we went on the streets to actually find the real users of the app and get their opinions.

Here is a gist of what they said:

- Extremely high interest rates of up to 60% per annum, so basically it will take you into a debt trap

- A lot of hidden charges

- Deceptive loan terms

- Some users said the principal amount remains the same even after paying the installments

- Harassing calls to pay the loan before deadlines (20-30 calls a day)

- Extremely poor customer support

- Some users said that the 5-star ratings were fake

- The app shares the documents and other details of the user with third-party apps

FlexSalary Loan App Interest Rate

The FlaxSalary provides a loan ranging between ₹8,000 and ₹3,00,000 depending on the customer’s CIBIL Score.

The interest rate is dependent on two things:

- Loan amount

- CIBIL Score

Apart from the interest rate, there are other charges and fees which has to be borne by the loan applicant.

| Limit | ₹ 8,000 – ₹ 3,00,000 |

| Interest Rate | Up to 36.5% |

| Conditional Interest on Continued Line Usage | Up to 21% |

| Annual Percentage Rate (APR) | 49% – 65% |

| Tenure | 36 Months |

| Processing Fee | ₹ 100 – ₹ 3,000 |

| Transaction Fee | ₹ 0 – ₹ 12 |

| Late Fee | Up to ₹ 150 |

| Auto-Debit Failure Charges | ₹ 0.00 |

| Pre – Payment Penalty | ₹ 0.00 |

However, some users claim that they have to pay an interest of up to 60%.

The maximum tenure the loan can take is up to 36 months (3 years).

How to Apply FlexSalary Loan App

The only thing good about the FlexSalary app is the easy and simple loan application process.

Anyone willing to take a loan using this app can easily apply and get the line of credit within 24 hours.

Here is how you can apply for the loan on FlexSalary:

- Download the App: Download the FlexSalary loan app or visit the official site

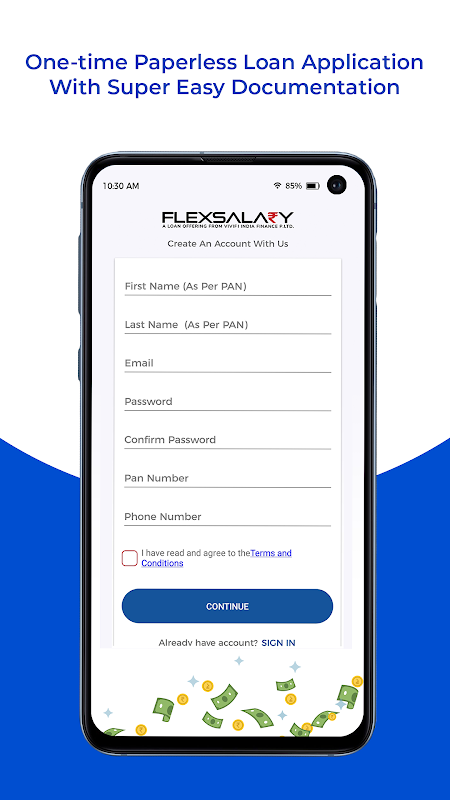

- Register: register yourself on the app by entering your details. If you are on the website, in the top right corner click on apply and register yourself

- Verify Details: once registered, the app will show your details like salary, CIBIL score, and the amount of loan you are eligible for

- Select Loan Amount: you have the option to select the amount of loan you want from the available credit limit

- Verify Bank Details: now you need to verify your bank details in order to receive the credit loan

- EMI Set-up: once verified set your EMI with NPCI for easy repayment

If you face any difficulties in applying for the loan, you can contact their customer support for help.

FlexSalary Customer Support Details

| Customer Care | Call: +914046175151 Whatsapp: +919908935151, +919100038349 |

| support@flexsalary.com | |

| Location | Unit A, 9th Floor, MJR Magnifique, Survey No 75 & 76, Khajaguda X Roads, Raidurgam, Hyderabad, Telangana – 500008 |

| Social Accounts | Facebook, X, Linkedin, Instagram |

How to close a FlexSalary account?

To close or delete your FlexSalary account, you need to contact their customer support at support@flexsalary.com or at +91-40-4617-5151 to start the account closure process.

Before the account closure, you need to pay all the EMIs and dues.

In order to proceed with the account closure you need to provide your details to the support team and follow the instructions to verify your account.

How to change your bank account in FlexSalary?

To change your FlexSalary account, open the app and go to the ‘My Account’ section, select the loan account you want to change, and click on ‘Change Bank Account’.

Verify your details and enter your new Bank account details.

How to increase the FlexSalary loan limit?

The loan limit depends on your salary and CIBIL score. To increase your loan limit you need to improve your CIBIL score by paying the loans on time.

You can also try to increase your salary.

Is the FlexSalary App Safe?

Yes, it is safe to use as the app is RBI-approved, but you must read all the related information and reviews before making any decision.

To Wrap up

The FlexSalary loan app may seem like an instant way to get financial help, but as per the users, most of them fall into the debt trap due to the extremely high interest rates.

As per the ratings and reviews of the users, the app does not perform satisfactorily well.